Performance

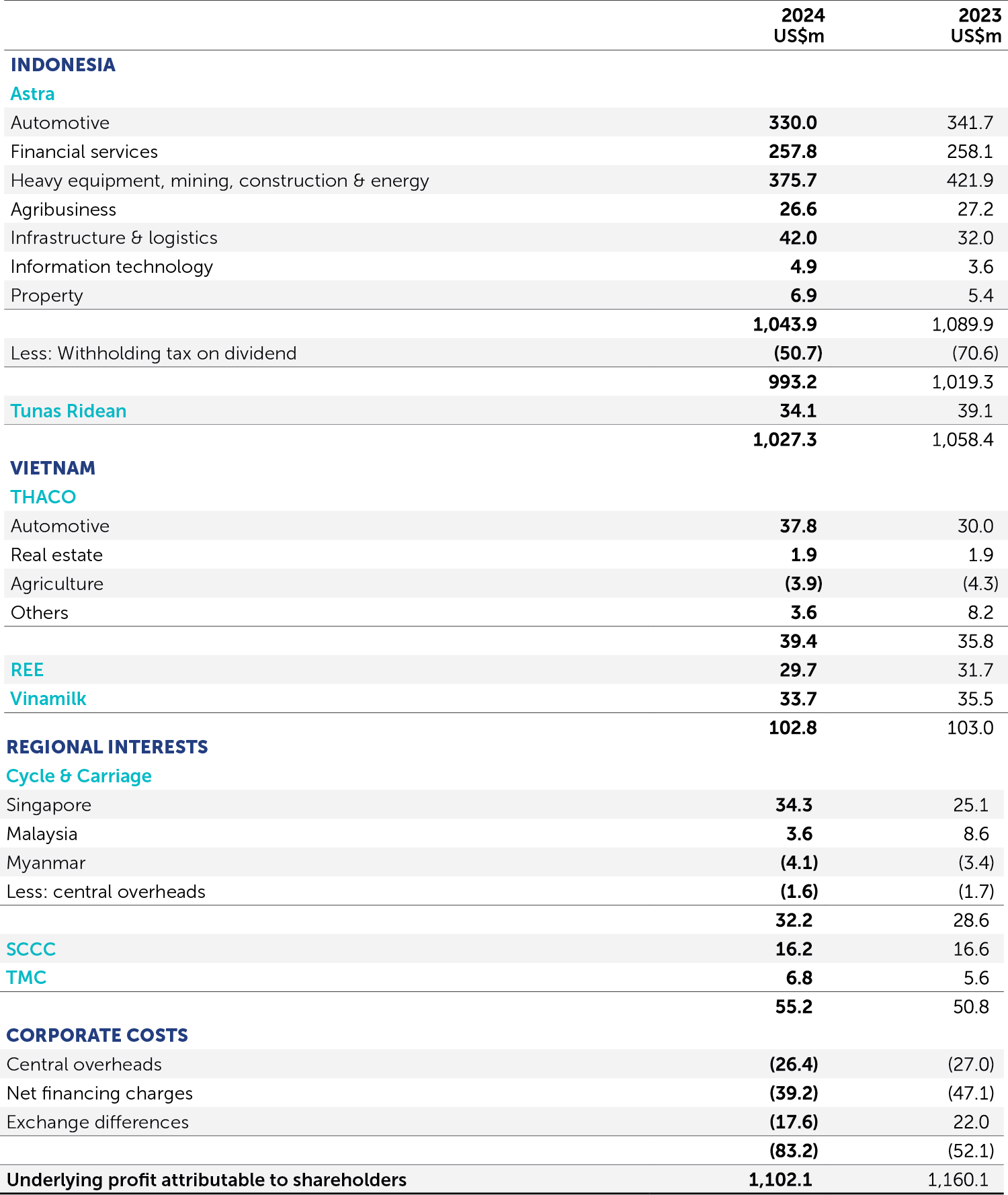

The overall JC&C portfolio demonstrated earnings resilience in 2024, although the Group was affected by foreign exchange differences which led to a 5% decline in underlying profit to US$1,102 million.

Corporate operating expenses remained stable, but largely due to the translation of foreign currency loans – with a swing from a foreign exchange gain of US$22 million last year to a loss of US$17 million this year – corporate costs increased from US$52 million to US$83 million. The impact of the translation was partly offset by a reduction in other corporate costs, with a US$8 million decrease in financing charges, in line with the lower corporate net debt.

After accounting for non-trading items, the Group’s profit attributable to shareholders was US$946 million, 22% lower than the previous year. The non-trading items reported in the year mainly comprised a US$127 million loss from the disposal of SCCC and unrealised fair value losses of US$28 million related to non-current investments.

There has been increased focus and discipline in managing the Group’s portfolio in order to dispose of non-core businesses, and this resulted in the Group’s consolidated net debt position, excluding the net borrowings within Astra’s financial services subsidiaries, falling to US$235 million at the end of 2024, compared to US$1,145 million at the end of 2023. This decrease reflected JC&C’s lower corporate net debt of US$816 million, compared to US$1.3 billion at the end of 2023, as well as Astra’s improved operating cash flow. Net debt within Astra’s financial services subsidiaries increased from US$3.4 billion at the end of 2023 to US$3.7 billion.

Underlying Profit Attributable to Shareholders by Business

The Group’s Indonesian businesses contributed US$1,027 million to its underlying profit, down 3%.

Astra’s toll roads on the Trans-Java network

Astra contributed US$993 million to JC&C’s underlying profit, 3% lower than the previous year, due to the translation impact from a weaker Indonesian Rupiah. On a rupiah basis, however, Astra has delivered another year of record earnings, mainly due to higher earnings from its motorcycle sales, financial services, and infrastructure and logistics businesses.

Net income decreased by 2% to US$705 million, as a higher contribution from the motorcycle business was offset by the impact of lower car sales in a softer market.

Net income increased by 6% to US$525 million, due to higher contributions from Astra’s consumer finance businesses.

Net income decreased by 5% to US$754 million, mainly due to lower earnings from Astra’s coal mining businesses, partly offset by improved profits from its mining contracting and gold mining businesses.

Net income increased by 9% to US$57 million, mainly as a result of higher crude palm selling prices, partly offset by lower sales.

Astra’s infrastructure and logistics division reported a 37% increase in net profit to US$84 million, primarily due to improved performance in its toll road businesses, which saw a 5% increase in toll revenues. Astra has 396km of operational toll roads along the Trans-Java network and in the Jakarta Outer Ring Road.

Tunas Ridean contributed US$34 million, 13% lower than last year. This was due to lower profits from its automotive operations. Motorcycle sales declined 5% to 259,000 units, while car sales were 7% lower at 40,000 units.

JC&C’s businesses in Vietnam contributed US$103 million to its underlying profit, unchanged from the previous year.

THACO’s mixed-use development in Ho Chi Minh City’s Thu Thiem New Urban Area

THACO contributed a profit of US$39 million, 10% up from the previous year. Its improved automotive profit benefitted from registration tax incentives implemented in the second half of 2024, with unit sales 10% higher. Its agricultural operations made a loss due to continued ramp-up of the business.

REE contributed a profit of US$30 million, 6% down from 2023. REE’s performance was affected by lower earnings from its power generation business, due to unfavourable hydrology and lower hydropower demand.

JC&C’s holding in Vinamilk produced a dividend income of US$34 million, compared to US$35 million in the prior year.

Regional Interests contributed US$55 million, 9% higher compared to 2023.

smart #1 all-electric car

The contribution from Cycle & Carriage was 13% higher at US$32 million. This was mainly due to improved profitability from the Singapore business, where new car sales were 16% higher at 6,500 units. Used car sales were 22% higher at 5,800 units.

The Group’s holding in TMC produced a dividend income of US$7 million, compared to US$5 million in the previous year.

Corporate costs increased from US$52 million to US$83 million, mainly due to foreign exchange losses, partly offset by lower net financing charges.

We expect continuing resilience from our portfolio companies as they address ongoing challenges from subdued consumer sentiment across our markets. We will continue to apply a disciplined focus on delivering higher performance from our core businesses, supported by our ongoing actions to build future flexibility into our balance sheet, and we remain confident in the prospects in our core markets including Indonesia and Vietnam.

Ben Birks

Group Managing Director